I’ve made a habit of updating my projections towards hitting financial independence every two years since starting this blog. This is the fourth entry in this series.

When I started this blog in July 2019, my FIRE target was an even $1 million and my goal was to retire by age 40. Inflated to August 2025, the latest month for which the BLS has inflation data, that’s $1.26M in today’s dollars. However, my expenses have gone up over time, especially since buying a home, which means my required retirement portfolio balance has gone up as well. I’m now 32 and been in the work force for a decade, so I’d like to check up how my financial trajectory is looking.

Looking at the past six months of my spending for some recent data, I spent an average of $5,108.83 per month. This is much higher than last time I did a FIRE projection update — my fall 2023 average monthly spend was $3,756 per month — and it includes the very large expense of redoing the roof on my house, however large expenses like that will be part of early retirement as well so I’m going to roll with it rather than cook the data.

Using the oft-quoted “four percent rule”, essentially multiplying my projected annual expenses by 25, results in an estimated required retirement portfolio balance of $1.532M.

For the purposes of calculating my total retirement savings, I need to exclude my home equity. I essentially just subtract out the home equity component from my net worth ($678,631) to obtain the total value of my liquid investable assets: $528,744.

I can now use a compound interest calculation to project my investment value forward while accounting for continuing to save $4,676 per month (an average taken from my past six months of data), along with my expected average rate of investment return, for which I like to use a 5% real return.

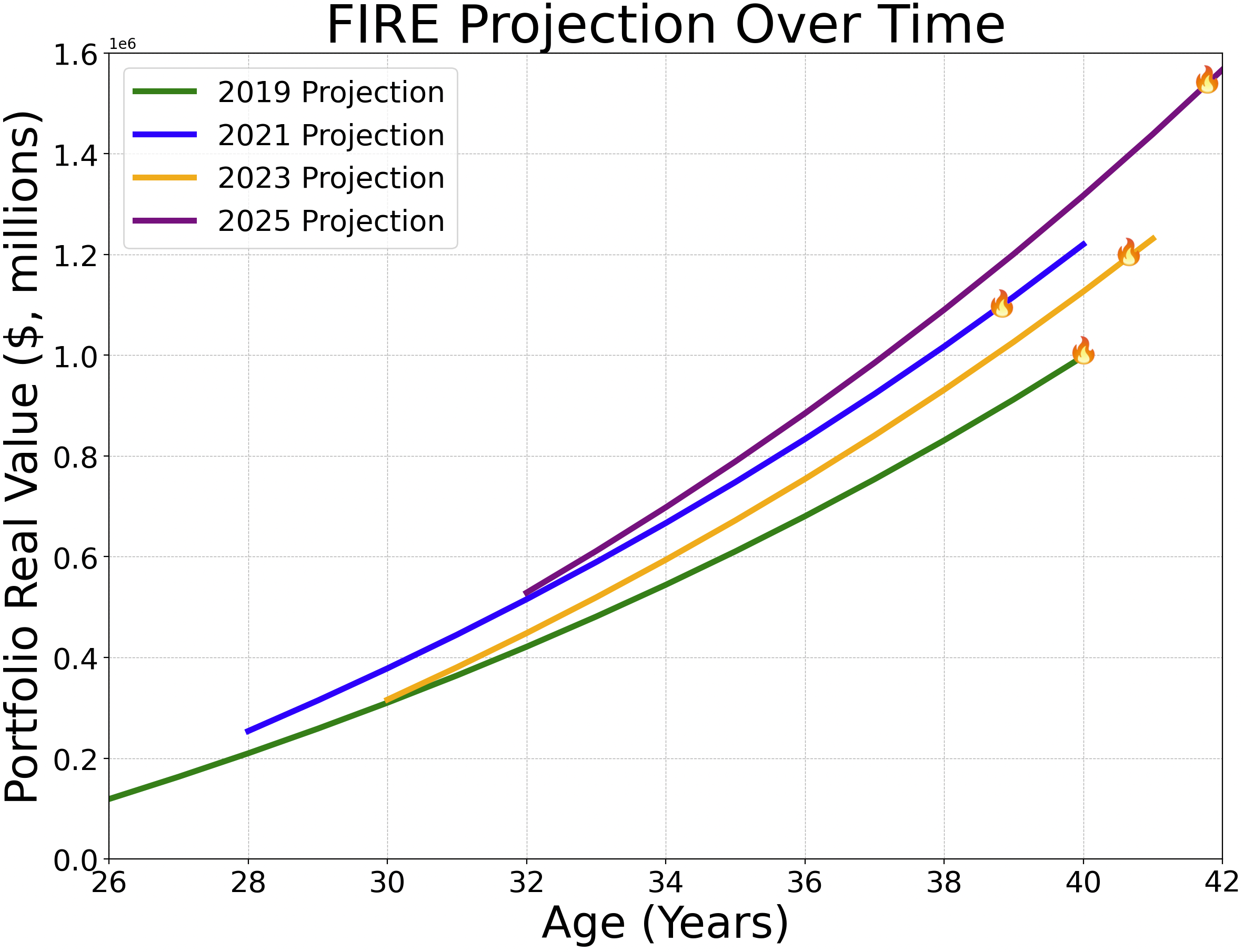

Calculating out this data until I hit my required FIRE portfolio balance of $1.532M, and then graphing it on the same graph I’ve been collecting the previous six years of data on, using purple for 2025’s projection, I get the following neat visual:

My FIRE date has pushed back to around 42 years old in this projection which would occur in the year 2035. This shift is clearly due to my high recent expenses; we can see that I currently have a higher FIRE portfolio balance than expected at any previous projection, and the 2025 projection accelerates away from the other lines, indicating that I’m also saving more than expected during any previous projection.

If I am able to reduce my average expenses over time, that will help slide my early retirement date to the left again. To be back on track to retire at 40, I’d need to reduce my expenses to around $4,300 per month, which seems like a reasonable reduction especially once the big home renovation projects have been completed.

Another consideration, where am I in terms of “coast FIRE” i.e. if I never saved another penny, how long would it take my investments to grow to hit my FIRE number in real terms? About 22 years, assuming a 5% real return! Assuming I can find work that is enough just to pay my living expenses, I’d still be able to retire comfortably at age 54, which is certainly still early by average American standards.

One final interesting way to look at my progress — my current liquid investable assets of $528,744 would support at a 4% withdrawal rate a monthly expenditure of $1,762. That’s some pretty respectable passive income, although certainly not enough to live off of with my current lifestyle!